Considerations

The Contract and Grant Manual provides guidance on the solicitation, acceptance or execution, and administration of awards from extramural sponsors.

Since contract and grant administration must synthesize the internal functions of an institution and external sponsor requirements, this Manual provides guidance on the University's policies related to the requirements of major external sponsors, such as the federal government and the State of California.

Roles and Responsibilities

The proposal preparation process requires the participation and coordination of multiple parties. A proposal is initiated by a Principal Investigator (PI), but there is an administrative support system that ensures the PI can prepare and submit a high-quality proposal package that meets both sponsor and institutional requirements. The Office of Research and Economic Development (ORED) supports PIs by providing technical proposal development support through the Office of Research Development (ORD), administrative proposal preparation and award negotiation & acceptance through the Sponsored Projects Office (SPO), and non-financial post-award administration through Contract & Grant Administration (CGA).

Proposal Preparation Roles and Responsibilities

| Roles | |

| R |

Responsible for the current and through completion of the work to achieve the task |

| S |

Support for those who are responsible |

| C |

Consulted as needed in order to complete the task (two-way communication) |

| Responsible Party | |

| PI |

Principal Investigator |

| RA |

Preaward Research Administrator |

| CGO |

Contract & Grant Officer |

| Tasks | PI | RA | CGO |

| Completion of the Proposal Submission Request (PSR) | R | S | |

| Disclose conflicts of interest and commitment | R | ||

| Disclose human subjects research | R | ||

| Disclose animal research | R | ||

| Disclose hazardous research materials | R | ||

| Disclose export controls involvement | R | ||

| Identify related intellectual property disclosures | R | ||

| Prepare proposal that meets requirements outlined in the sponsor's application instructions, including applicable rules and regulations | S | R | C |

| Prepare technical proposal | R | ||

| Prepare proposal that meets requirements outlined in the sponsor's application instructions, including applicable rules and regulations | S | R | C |

| Identify the appropriate indirect cost rate | R | C | |

| Request an indirect cost policy exception request, if appropriate | R | C | |

| Develop appropriate budget and budget justification to accomplish the scope of work | S | R | |

| Verify that budget items are in accordance with Uniform Guidance (which also includes cost account standards) | R | C | |

| Request on-or-off-campus space needed in addition to that already assigned to the PI | R | S | |

| Request modifications or renovations to on-campus or off-campus space if necessary | R | S | |

| Request cost share and matching funds according to University policy | R | S | |

| Obtain letters of support of collaborators | R | S | |

| Request and obtain budget, scope of work and relevant documents from subcontractors and consultants | S | R | |

| Complete and route Cayuse proposal record | S | R | |

| Certification of the Cayuse record | R | S | |

| Monitor Cayuse record progress as it routes through the internal review process | R | ||

| Perform review of proposal according to sponsor and institutional requirements | R | ||

| Address issues with proposal identified by Contract and Grant Officers | S | R | |

| Act as institutional authority as to acceptability of sponsor requirements | R | ||

| Maintain database of proposal submissions and awards (Cayuse) | S | R |

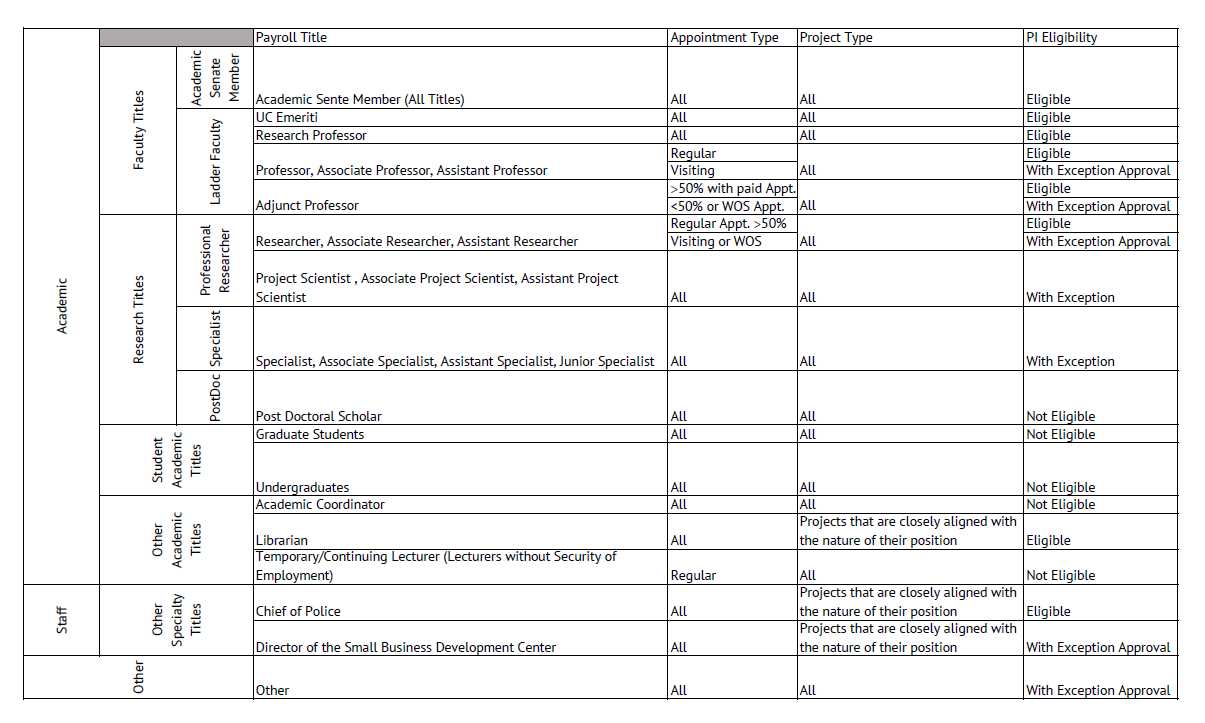

Principal Investigator Eligibility

The University of California Contract & Grant Manual identifies the following individuals as eligible to serve as Principal Investigators for extramural contracts or grants.

Eligibility Matrix

Resources

Contract and Grant Manual - Chapter 1-500: Principal Investigator Guidelines

Academic Personnel - APM 110-4 Academic Senate Member

Members of the Academic Senate, including the following titles, whether in regular or emeritus status:

- Chancellor

- Vice Chancellor

- Dean (Academic)

- Professor

- Associate Professor

- Assistant Professor

- Research Professor

- Director of Academic Program

- University Librarian

- Chief Admissions Officer

- Registrar

- Lecturer/Senior Lecturer with Security of Employment or Potential Security of Employment

- Appointees 50% time or greater in the Professional Researcher series.

- Titles include: Assistant Researcher, Associate Researcher, Researcher

- Appointees 50% time or greater in the Adjunct Professor series.

- Titles include: Adjunct Instructor, Assistant Adjunct Professor, Associate Adjunct Professor, Adjunct Professor

Principal Investigator Exceptions

Deans and ORU Directors must approve PI exception requests. However, the authority to approve exceptions to Principal Investigator status's eligibility requirements is vested in Vice Chancellor for Research. A Request for Exception to PI Status Form must be requested by the RA and approved by the Dean/ORU Director and VCR. A copy of the approved exception form must be included in the Cayuse proposal record prior to routing.

Budget Preparation and Resources

Your budget is a financial proposal that reflects the work proposed. It outlines the expected project costs in detail and should mirror the project description. A budget is presented as a categorical list of anticipated project costs representing the researcher's best estimate of the funds needed to support the proposed work. The term "best estimate" is essential here. You will be held accountable for using the costs detailed in your budget, so ensure you've correctly estimated what you will need to complete the project.

Reviewers want to know how reasonable the cost of your project is. They will ask themselves whether you are over or underestimating your expenses. A careful review of the budget lets the reviewer know that you're not asking for too much or too little, but rather, just enough funding.

A UCM internal budget should be prepared for each proposal. The internal budget will help complete any sponsor budget forms and the budget justification and assist with sponsor requests for additional details about how you generated your overall figure or where the money will be going. Remember, all budgets must be prepared following the Office of Management and Budget (OMB) Uniform Guidance (the UG) and University Cost Standards.

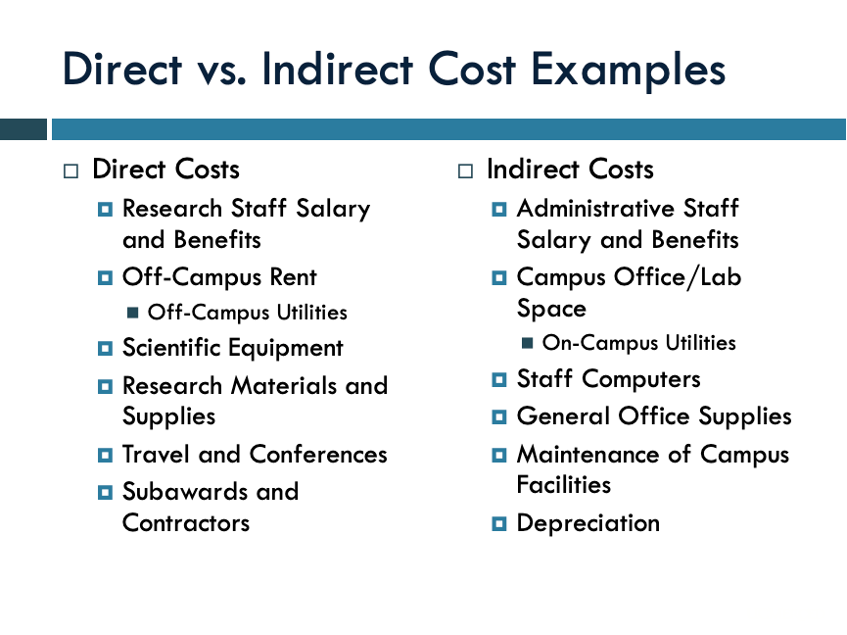

Direct and Indirect Costs

In sponsored awards, a proposal budget consists direct and indirect costs. Direct costs are expenses that can be easily and accurately linked directly to a particular sponsored project. Indirect costs are the other “costs of doing business” that cannot be applied directly to any one specific project.

- Direct Costs include:

- Paid employee effort, including benefits

- Equipment, materials and supplies

- Foreign and domestic travel

- Contractors, consultants and subawards

- Indirect Costs (IDC)

- Facilities & Administration (F&A)

- Overhead

Budget Format

The Sponsored Projects Office (SPO) developed a budget template that should be included with all proposals. The controlled document titled, “SPO-1035 Internal Budget Template" is maintained by SPO. The budget template cannot be substituted with other formats.

Salaries and Wages

Paid Employee Effort

Different types of employees can be paid from a sponsored project, and would thus need to be captured in a proposal budget:

- PI Salary

- Professional Research Staff

- Post-Doctoral Scholars (Post Docs)

- Graduate Student Researchers (GSRs)

- Can include Tuition and Fee Remission

- Undergraduate Students

- Hourly employees can be subsidized by Work-Study

In order to accurately capture an employee’s cost in a budget, we need to know:

- Title/Step

- Pay Rate (usually monthly)

- Months of Effort per year

- % of Effort per month

(Pay Rate) x (Months of Effort) x (% of Effort) = (Cost of Employee)

PI Summer Salary

Most faculty are on a nine (9) month academic appointment, and therefore have three (3) summer months to dedicate to research each year. PI Summer salary is calculated as 1/9th of their academic year salary. Faculty are paid their nine (9) month academic appointment over twelve (12) months, so their regular paycheck is NOT the same as a summer ninth.

Example:

(Pay Rate) x 1/9 = (Summer Salary)

($80,000) x 1/9 = $8,888.89

Graduate Student Researchers/Employees

Graduate student researcher employees can work up either at either 25% of 50% appointment during the academic year and up to 100% time for three (3) summer months. Graduate Student Researchers (GSR) qualify for full fee remission with an appointment of 25% or greater. GSR salary schedules are established by UCOP and can be found on their Academic Personnel and Programs webpage.

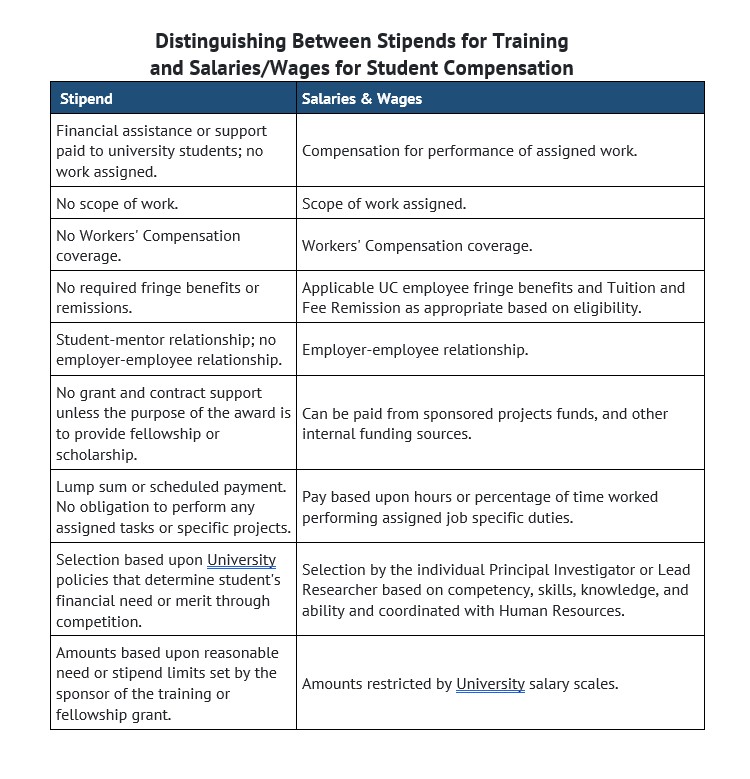

A stipend is a payment made to graduate and undergraduate students for educationally related activities, such as scholarships, fellowships, financial assistance or training grants. It is intended to support educational or training expenses, including tuition, living costs, and other incidental expenses, and is not compensation for services rendered.

Stipends should not be paid for work performed by a student that is similar to work currently paid to other students as wages. Stipends are also not appropriate for work without a direct connection to a student's educational studies or research. Stipends may not be used to avoid wage and hour reporting requirements, overtime pay, or minimum wage requirements.

Stipends are generally paid to students whose activities related to the stipend are substantially unsupervised and whose hours of work are not easily tracked. For example, participants part of a training grant may be eligible for stipends because their activities are performed intermittently and during irregular hours.

The amount of the stipend must be determined to ensure that the student receives compensation at or above the applicable minimum wage, given a reasonable estimate of the amount of time that the student will dedicate to the activities. The reasonable estimate of the amount of time that the student will dedicate to the activities must be consistent with full-time student status, which is equal to no more than 20 hours of work per week during the school semesters.

Stipends cannot be paid to anyone other than students. Any additional compensation used to pay an employee temporarily assigned responsibilities of a higher-level position will be considered "additional pay."

Scholarships and fellowship grants are forms of financial assistance awarded primarily based on academic achievement and vocational and professional objectives. Generally, graduate and post-graduate students are not required to render services to the school as a consideration of their awards or to repay them. Payments for qualified scholarships, as well as payments to non-degree candidates and for non-qualified expenses that are not made as compensation for services rendered.

Undergraduate Student Employees

Student employees can work up to 45% effort (18 hour/week maximum) during the academic year, and up to 100% effort (40 hours/week) for three (3) summer months. They may also work up to 40 hours during the winter/spring breaks. Undergraduates are paid an hourly wage determined the Student Employment Services.

Benefits

Composite Benefit Rates (CBR) are used for budget development of proposals. CBRs are standard benefit rates developed each fiscal year and are used for business transactions containing a fringe benefit component. Our current practice assesses fringe benefits based on hundreds of detailed rates, and with the adoption of CBRs, individual employee fringe benefits will be assessed using one of the rates posted to the Division of Finance and Administration’s costing policy webpage.

Materials & Supplies

Materials and Supplies are consumable items such as lab supplies, clinical supplies, glassware, chemicals, reagents, etc. used to conduct the work scope for a project.

Equipment

Equipment means tangible personal property (including information technology systems) having a useful life of more than one year and a per-unit acquisition cost which equals or exceeds $5,000.

Equipment quotes must be included in Cayuse proposal records for each item of equipment included in a proposed budget (formal quotes are preferred, but internet or email quotes from a vendor are sufficient).

Subawards, Consultants, and Contractors

Subaward

A subaward is a formal written agreement made between UC Merced and another legal entity (subrecipient) to perform an intellectually significant portion of the scope of work (SOW) under a UC Merced sponsored project. A recipient of a Subaward (Subrecipient) is usually an institution that collaborates with the UCM Principal Investigator (PI). The Subrecipient performs and has responsibility for part of a sponsored project. Its services are of a specialized and specific nature and cannot be performed by UCM. A Subrecipient is normally reimbursed for expenses in arrears. UCM has the responsibility to monitor Subrecipient performance.

Proposed subrecipients must complete a "Subrecipient Commitment Form." A full Subrecipient Commitment Package (Subrecipient Commitment Form, Scope of Work, Budget, Budget Justification, etc.) must be included in the Cayuse proposal record before routing to the Contract & Grant Officer for review.

Consultant

A consultant is an independent contractor hired to provide expert advice for short or intermittent time periods. A Consultant may be an individual or an organization. The Consultant assists the UCM PI. Consulting services are primarily advisory in nature and address a clearly delineated problem or provide a fee-for-service function. A Consultant is normally paid based on an hourly or daily rate or a fixed price for deliverables.

A letter of commitment for each consultant included in a proposed budget must be obtained and included in the Cayuse proposal record before routing to the Contract & Grant Officer for review. The letter must include a brief description of the services to be rendered and an hourly rate for the services to be provided.

Contractor

A Contractor provides goods or services within normal business operations and operates in a competitive environment providing similar goods and services to a variety of customers.

The following are characteristics of a contractor/fee for service purchase order. The contractor organization:

- provides a routine service (e.g., equipment fabrication or repair, data processing, performing routine analytical testing services, etc.)

- provides the goods or services as part of its normal business operations

- operates in a competitive environment (i.e., competes with others who can provide a similar service)

- provides similar goods or services to many different purchasers

Other Direct Costs

Publications Costs/Open Access Journals

Consider including publication costs in your extramural project budget if you intend to publish your research findings. Publishing costs are an allowable direct cost unless explicitly listed in the funder’s RFA/RFP as an unallowable expense. The open access publishing fee, or article processing charge (APC), varies by journal. To make the most accurate estimate:

- Consider where you anticipate submitting your research for publication.

- Look up the APC on the journal’s website.

- If you do not know where you will publish, $3,000 per article is a reasonable estimate.

For more information, please review the UCOP Open Access Fact Sheet for Researchers Applying for Grants.

Graduate Student Tuition

Graduate Student Researchers (GSR) qualify for full fee remission with an appointment of 25% or greater. Tuition remission is a benefit paid to GSRs and a direct cost to the University.

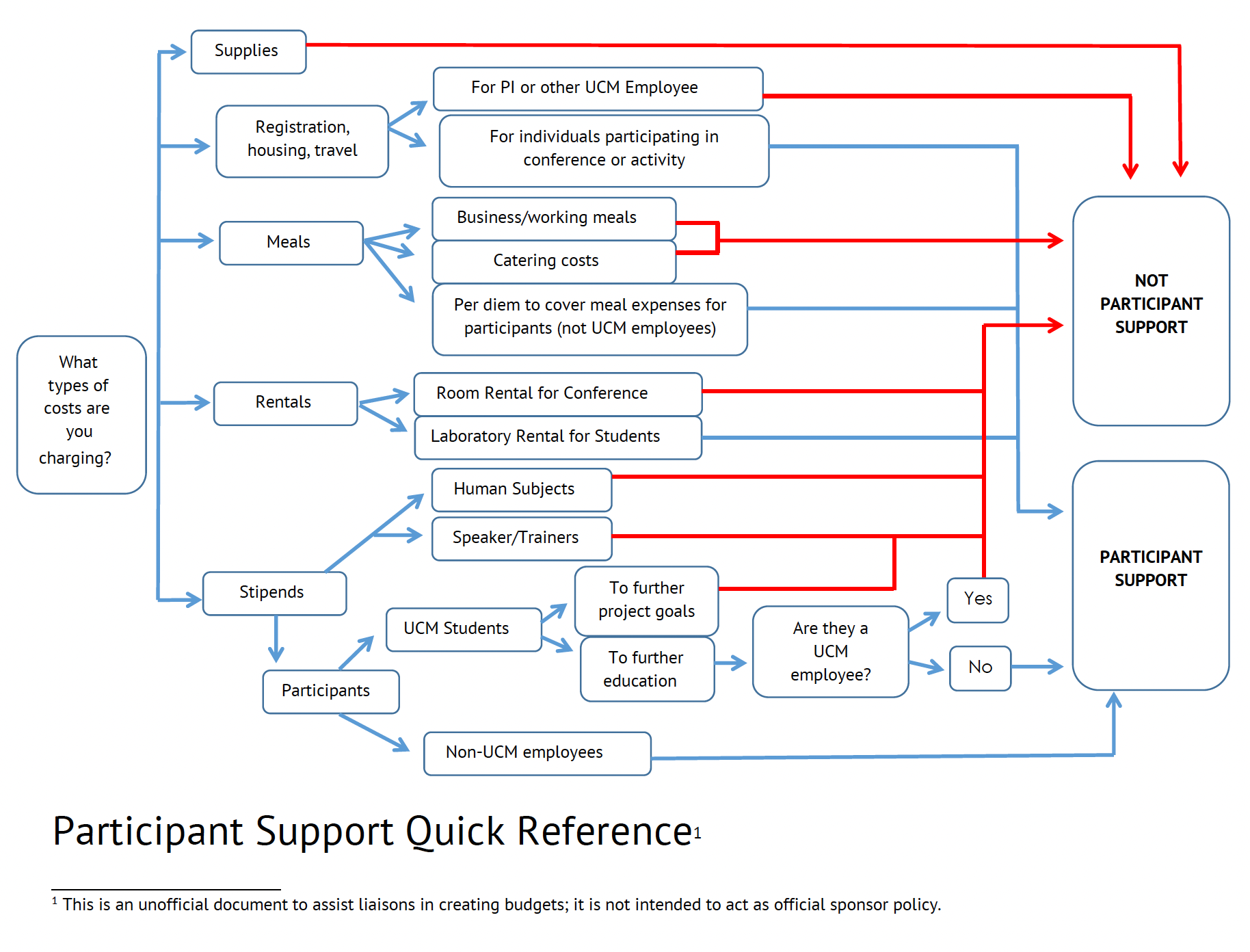

Participant Support

The National Science Foundation (NSF) defines this budget category as, “direct costs for items such as stipends or subsistence allowances, travel allowances, and registration fees paid to or on behalf of participants or trainees (but not employees) in connection with NSF-sponsored conferences or training projects.” Any additional categories of participant support costs other than those described in 2 CFR § 200.1 (such as incentives, gifts, souvenirs, t-shirts and memorabilia), must therefore be clearly justified in the budget justification of any proposal submitted to NSF, and such costs will be closely scrutinized by NSF. (See the NSF PAPPG, Chapter II.Dfor additional guidance.)

Furthermore, under the Uniform Guidance (200.456) other federal sponsors also may allow PIs to budget and charge for participant support costs. The sponsor’s guidance on the definition and treatment of Participant Support Costs should be strictly followed. Please note: Participant support costs are not routinely allowed on research projects but may be charged with sponsor approval if the project includes an education or outreach component and the federal agency approves such costs. Human subject payments are not considered participant support costs.

Participant Support Costs must be explicitly listed in the proposal budget or approved by the funding agency (through SPO) after the award has been made. Payments of such costs without obtaining prior sponsor approval risk being disallowed by the sponsor. Participant support costs should be excluded from the Modified Total Direct Cost (MDTC) when calculating F&A costs when the University’s federally negotiated F&A rate is applied.

Indirect Costs

UC Merced’s indirect cost recovery (IDC) rate is negotiated with and established by the University’s cognizant federal agency – the Department of Health and Human Services (a copy of UCM’s agreement can be found here). The University of California has also negotiated an indirect cost recovery rate with the State of California. The IDC for proposal budget development is as follows:

All federal and non-state-funded projects

On-Campus: 58.5% Modified total direct costs (MTDC) (effective July 1, 2024)

Off-Campus: 26% MTDC

The off-campus F&A rate is used when:

Rented or leased facilities - The project is conducted at facilities not owned or leased by the University and rent or lease costs are directly charged to the project. The off-campus rate will not be applied when a principal investigator (PI) chooses to conduct their project off-campus for convenience (i.e. when campus or other University facilities are available).

Time and effort - when more than 50 percent of budgeted UC Merced time and effort is performed off‐campus.

State of California-funded projects between July 1, 2023 through June 30, 2026

On Campus: 35% MTDC

Off-Campus: 25% MTDC

State of California-funded projects after July 1, 2026

On Campus: 40% MTDC

Off-Campus: 25% MTDC

Indirect Cost Policy Exceptions

Any opportunity that limits the University's ability to recover the indirect cost (IDC) associated with performing the research needs to be reviewed and approved by the Vice Chancellor for Research and the University of California Office of the President (UCOP). An Indirect Cost Policy Exception Form will be completed by the RA and must be included in the Cayuse proposal record for projects that do not include IDC's full recovery.

IDC Policy Exception based on Sponsor Policy

The sponsor restricts the indirect cost recovery rate based on an established policy. Any sponsor documentation of its indirect cost recovery restriction should include all required elements needed to calculate the indirect cost recovery, including a rate and a base. Documentation should be unambiguous in describing how indirect cost recovery is calculated so that UC may recover its entitled indirect cost under a sponsor’s policy. If the sponsor’s policy is unclear, the research administrator should request clarification from the sponsor. The sponsor’s policy and URL link must be included in the Cayuse record before routing the SPO proposal.

IDC Policy Exception based on Campus Determination

In order for UC Merced to approve a request to reduce or eliminate indirect costs on a given project, a compelling reason showing that a higher University purpose will be served is necessary. Requests for exceptions are evaluated and approved by the Vice Chancellor for Research and are forwarded to the Office of the President for review.

Criteria:

- Small seed grants which may attract future larger awards that will result in standard indirect cost recovery;

- Awards which include contributions of equipment or building renovation funds;

- Awards for a community relations interest vital to the campus;

- Supplements for a student services activity which the campus must provide;

- Supplements for library holdings or public exhibits.

What will not be considered:

- Requests where the PI feels more funds are needed for direct costs than would otherwise be available;

- For-Profit Entities (or their private foundations) and Foreign Governments are not eligible for consideration under the campus determination because the University of California is a public, state-supported university. We are obligated to conduct and manage its operations and finances in a manner that fosters the responsible stewardship of public resources. Since reducing or eliminating indirect cost recovery on a project sponsored by a for-profit entity or foreign government constitutes a gift of public funds for private benefit.

Requests for campus-determined exceptions must be submitted for consideration at least 10 business days before the sponsor’s deadline. Each request will be considered independently on its own merits. Approvals are the exception rather than the rule.

IDC Policy Exception based on Special Approval (State of California)

If a State of California agency does not allow the IDC rate described in UC/CSU rates for State of California agencies, a ‘Special Approval’ request will need to be submitted to UCOP for their review. Special Approval guidelines apply whether the California State Agency is our direct Sponsor or the Prime Funding Agency to a subaward proposal.

Cost Share and Matching funds

Cost share are project costs that are not paid for by the sponsor. Sponsors can request cost share as part of the proposal budget. It can be a percentage of total project costs or a fixed dollar amount. For federal funds, the cost share must come from a non-federal source.

Sponsor Requested Budget + Cost share = Total Cost of the Project

Types of Cost Share

| Is the Cost Share QUANTIFIED? | |||

| Is the Cost Share REQUIRED? | Yes | No | |

| Yes | Mandatory Committed | N/A | |

| No | Voluntary Committed | Voluntary Uncommitted (not reported) | |

Mandatory Committed Cost Share

- Required by the sponsor and included as an award condition in the RFP

- Included in proposal submission, budgets and budget justification

- Legally binding obligation to the sponsor

- Must be tracked and reported

- Certified effort reporting for federal awards

Voluntary Committed Cost Share

- Not a condition of the sponsor or RFP

- Included in proposal submission, budgets and budget justification

- Legally binding obligation to the sponsor

- Must be tracked and reported

- Certified effort reports for federal awards

Voluntary Uncommitted Cost Share

- Defined as effort over and above that which is committed and budgeted for in a sponsored agreement

- PI does not quantify a specific commitment of effort or research costs in the proposal

- Not tracked on the ledger or reported to the sponsor

- This is really about writing budget justifications where a PI is engaged with the research but isn’t direct charging effort to the project

Sources of Cost Share Commitments

Internal (University) Sources

- Campus funds from PI, department, VCR, Chancellor, etc.

- Faculty or staff effort and associated benefits

- Indirect Costs

External (Third-Party) Sources

- Non-UC collaborators or subrecipients

- Another sponsored agreement (grant-to-grant)

- Donated supplies, equipment or services (in-kind)

Using Indirect Costs as Cost Share

Waived IDC

- The difference between Merced’s federally negotiated IDC rate and the sponsor’s lower IDC rate This is used when the sponsor will only pay a lower indirect rate AND they require a cost share commitment.

Unrecovered IDC (or Computed IDC)

- Calculated based upon applicable direct costs when the matched fund source does not accrue IDC. This is used when cost-sharing from university sources like discretionary accounts to maximize the university’s match

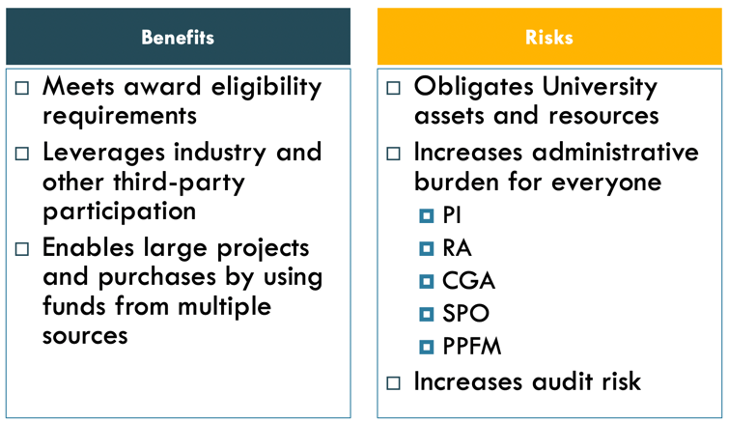

Benefits & Risks of Cost Sharing

Obtaining Cost Share Letters

| Pre-Award Cost Share Activities | PI | RA |

|---|---|---|

| Review sponsor guidelines for cost-share requirements | X | X |

| Identify and determine cost-share funding sources | X | |

| Obtain approvals from Dept. Chair and VCR | X | X |

| Obtain letters of commitment from subrecipients or third parties | X | |

| Prepare cost share budget to the same level of detail as in sponsor's requested budget | X |

Cost Share Letters – University

- Must be allowed under the Proposal Guidelines

- PI requests from their Chair/Dean (the letter should come from the person who has the authority of the funding source)

- RA can help create the initial draft of the letter to make sure that it includes accurate financial information

- Letter must have:

- Source of cost share – department, another grant (can't use another grant unless an approval letter from the sponsor is provided), gift, etc.

- Type of cost share – salary, equipment, funds, etc.

- Value of cost share (and effort if applicable)

- Commitment from the Chair/Dean or others to provide the stated cost share for the named project

- Letter must be signed

- Cost Share Letter(s) must be included in the Cayuse proposal record prior to routing to the Contract & Grant Officer

Cost Share Letters – Third Party

- Must be allowed under the Proposal Guidelines

- PI requests from the third party

- Letter must include:

- Type of Cost Share – salary, equipment, space, etc.

- Value of Cost Share (and hours/effort if applicable)

- Letter must be signed

- Cost Share Letter(s) must be included in the Cayuse proposal record prior to routing to the Contract & Grant Officer

Cost Share Letters – Waived indirect costs (IDC)

- Must be allowed under the Proposal Guidelines

- Essentially the same as a Vital Interest Waiver

- PI writes letter to VCR requesting the waiver

- Letter must include:

- Requirement of agency (mandatory or voluntary)

- Allowability from agency

- Statement of need (financial)

- Letter must be signed and on UC Merced letterhead

- Cost Share Letter(s) must be included in the Cayuse proposal record prior to routing to the Contract & Grant Officer

Grant vs. Gifts

There are several mechanisms for external entities to provide financial support to University researchers. Grants/contracts and gifts are the most commonly used. Each mechanism has a unique function, but some sponsors use the terms interchangeably. University Office of the President has outlined the characteristics of both grants and gifts in the Contract and Grants Manual (Chapter 9-500). The University must exercise judgment to classify the grant/contract vs gift following the intent of UC policy. Each proposal opportunity or award should be thoroughly reviewed to reach the appropriate classification. As of 3/10/22, UCOP has also instituted a policy on the Classification of Gifts and Sponsored Awards. This policy lists the following three determinative indicators of a Sponsored Award. The presence of any of these indicators determines that funding should be considered a Sponsored Award rather than a gift:

Determinative Indicators of a Sponsored Award

● Support is from the United States federal government

● Testing or evaluating of proprietary materials (including software) provided by, or on behalf of the Funder, is involved, or

● University intellectual property rights are given to Funder, and/or Funder directs the dissemination and/or management of University results, including intellectual property.

Further Considerations when making a grant vs gift determination

| Question | Gift | Grant/contract |

|---|---|---|

| Does the project have a Scope of Work? | Gift funding is generally provided to support a field of research of interest to the funder and does not include a specific period of performance. | If the funding is for a project-specific scope of work the project should likely be classified as a grant/contract. |

| Are there terms and conditions associated with the proposal opportunity or award? | Gifts should be unrestricted without the expectation of any quid pro quo. | If there are binding terms and conditions that include language on confidentiality, publication, copyright, patent rights, liability, insurance, regulations, allowable costs, subcontracting or any other type of contractual term, the project should be classified as a grant. |

| Are there deliverables or reporting requirements? | Gifts should not include milestones/deliverables and generally should not include progress or financial reporting. | Milestones, deliverables, and reporting are characteristics of a grant/contract. |

| Can the sponsor request the return of unexpended funds? | Gift funding is generally irrevocable. | Grants/contracts generally include provisions stating that unexpended funding should be returned to the sponsor. |

| Does the sponsor allow for the recovery of indirect costs? | Gifts do not generally allow for indirect cost recovery. | Grants/contracts generally include indirect cost recovery. |

Grant and gift characteristics as outlined by the Contracts and Grants Manual (Chapter 9-500)

| Gift | Grants/contract |

|---|---|

| Donor does not impose contractual requirements | Provision for audits by or on behalf of the grantor |

| Funds are awarded irrevocably | The grantor is entitled to receive some consideration such as a detailed technical report of research results or a report of expenditures |

| Testing or evaluation or proprietary products is involved | |

| The research is directed to satisfying specific grantor requirements (e.g., terms and conditions stating a precise scope of work to be done rather than a general area of research) | |

| A specified period of performance is prescribed or termination is at the discretion of the grantor | |

| Funds unexpended at end of period shall be returned of the grantor | |

| Patent rights requested by grantor |

Proposal Development FAQ

How are tuition and fees paid/split when a graduate student's salary is split between two grants or between a TA appointment and a GSR appointment?

They are generally split proportionately between the two assignments. However, there are different circumstances where you should reach out to Graduate Division for advice or to confirm the split (i.e., when one fund is a full overhead-bearing award and the other fund is not).

Do multi-campus awards ("subawards" to other UC campuses) assess indirect costs?

Unlike subawards, which assess indirect costs on the first $25,000, multi-campus awards to sister campuses are excluded from the MTDC base and do not assess indirect costs.

Why can't participant support stipends be used to pay individuals who work on a grant?

Participant support stipends are intended to cover the costs of participation in a grant-funded project or activity, such as travel, lodging, and meals. They are not meant to be compensation for work performed on the project. This distinction is important for several reasons:

- Participant Support vs. Compensation: Participant support stipends are not considered compensation for services rendered, while compensation is the payment for work performed. This distinction is important for tax purposes and for ensuring that individuals are not misclassified as employees.

- Grant Scope and Objectives: Grant funds are typically awarded to support specific project activities or research goals. Participant support stipends are intended to facilitate participation in these activities, not to pay for the work itself.

- Grant Budget Breakdown: Grant budgets are typically divided into direct costs (expenses directly related to the project) and indirect costs (overhead expenses). Participant support stipends are classified as direct costs, but are excluded from the indirect cost base. Salaries and wages for employees are considered direct costs and assess indirect costs.

- Federal Cost Principles: Federal cost principles, which govern the use of federal grant funds, stipulate that participant support stipends cannot be used to compensate individuals for work performed on a grant.

- Grant Compliance and Accountability: Using participant support stipends to pay individuals who work on a grant could be considered a violation of grant terms and conditions, leading to potential consequences such as funding suspension or termination.

- Ethical Considerations: Misusing grant funds for purposes other than those intended, such as using participant support stipends to pay for work, could raise ethical concerns and potentially damage the reputation of the grantee institution.